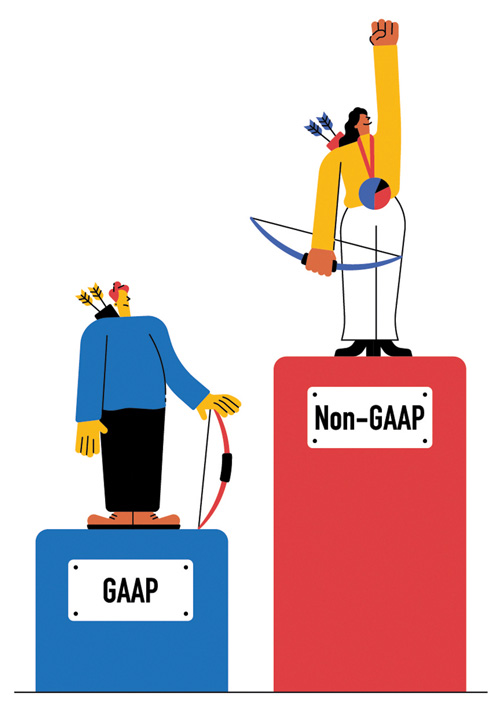

Research - WHEN THE GAAP FALLS SHORT

A new study by financial reporting expert Stephannie Larocque finds that forecasters who use non-GAAP performance metrics are more accurate.

For the better part of a century, Generally Accepted Accounting Principles (GAAP) have dominated how publicly traded companies, nonprofit organizations and government entities report their finances. Developed in the wake of the 1929 stock market crash and the ensuing Great Depression, these standardized reporting rules have made financial statements easier to comprehend and compare while also keeping companies accountable and transparent.

For financial analysts, GAAP measurements have historically been the gold standard for assessing firms’ performance and issuing forecasts for investors. However, non-GAAP reporting is on the rise and affecting forecast accuracy as well as market reactions to companies’ earnings surprises, according to the paper, “Filling in the GAAPs in Individual Analysts’ Street Earnings Forecasts.” Published in Management Science, the paper is co-authored by Stephannie Larocque from the University of Notre Dame’s Mendoza College of Business, Brian Bratten of the Gatton College of Business & Economics at the University of Kentucky, and Teri Lombardi Yohn of the Goizueta Business School at Emory University.

“It’s much more common now,” said Larocque, an associate professor of accountancy and the KPMG Faculty Fellow at Mendoza. “About two-thirds of companies these days will issue a non-GAAP metric in addition to the GAAP earnings that they have to report.”

“It’s much more common now,” said Larocque, an associate professor of accountancy and the KPMG Faculty Fellow at Mendoza. “About two-thirds of companies these days will issue a non-GAAP metric in addition to the GAAP earnings that they have to report.”

She explained that there are two schools of thought regarding why companies increasingly use non-GAAP alongside the required GAAP metrics. “Some believe that companies do it to provide earnings metrics that are more informative and that might help people better understand or predict the future,” she said. “The other side is that non-GAAP reporting might be used to make the company look better. So it’s the company being opportunistic and taking out the bad stuff to have a higher non-GAAP earnings number, which a lot of the time makes the company look better, and maybe results in a higher valuation.”

Larocque is keenly aware of how GAAP is used by analysts, having worked as a financial analyst for UBS Securities before teaching financial statement analysis to Notre Dame Master of Science in Accountancy students and principles of accounting to Executive MBAs. Her research encompasses empirical capital markets, including analysts’ forecasts, private equity funds and companies’ cost of equity capital.

“In general, the research I do is informed by what I did when I was a financial analyst,” she said. “I also recognize that things change a lot over time and when I was an analyst there wasn’t a whole lot of non-GAAP reporting. It’s very common these days, which is intriguing to me.”

Prior research in the area has suggested that the choice to use non-GAAP, or “street” metrics, occurs at the firm level, but Larocque was skeptical its selection was limited to firms and not a choice made by individual analysts. She has already written a couple of studies on analyst street earnings forecasts with co-authors Bratten and Yohn, in one of which they created a measure of unexpected non-GAAP exclusions from street earnings. This time, they wanted to study whether different analysts following the same firm during the same quarter report both GAAP and non-GAAP metrics, or not, and what might be the effects of different reporting.

The research team hypothesized that analysts who forecast non-GAAP street earnings, as opposed to GAAP street earnings, issue higher quality forecasts, which in turn increases with the percentage of analysts using non-GAAP street forecasts. They compiled their results in their latest paper.

Pulling detailed forecast data from the Institutional Brokers Estimate System (I/B/E/S), Larocque and the other researchers identified different analysts issuing street forecasts for the same specific firm and quarter, going back as far as 2004. They evaluated the consequences of these differences for forecast accuracy, earnings surprises and earnings announcement stock returns.

“First and foremost, there are differences across analysts in their use of non-GAAP metrics,” she said. “For the same firm data, you’ve got differences across users in how they interpret or use that data. So then the next question is, does that affect the market reaction to earnings? It does.”

The researchers compared the forecast accuracy of GAAP versus non-GAAP street earnings. After controlling for the individual analyst’s characteristics, forecast horizon, inclusion in the I/B/E/S street forecast consensus and firm-quarter fixed effects, they found that when an analyst uses non-GAAP street earnings, their forecasts are more accurate. They further observed that when the percentage of analysts issuing non-GAAP street forecasts increased, the relative forecast accuracy also increased.

The researchers compared the forecast accuracy of GAAP versus non-GAAP street earnings. After controlling for the individual analyst’s characteristics, forecast horizon, inclusion in the I/B/E/S street forecast consensus and firm-quarter fixed effects, they found that when an analyst uses non-GAAP street earnings, their forecasts are more accurate. They further observed that when the percentage of analysts issuing non-GAAP street forecasts increased, the relative forecast accuracy also increased.

Larocque explained that these results actually tie in with the prevailing assumptions about why companies might prefer non-GAAP street forecasts for opportunistic reasons.

“When there are differences across analysts, it seems to be associated with negative earnings surprises in the future,” she said. “Those analysts who are forecasting using non-GAAP metrics are thinking carefully about the potentially bad, but transitory, things that won’t continue for a firm that they might want to remove or ignore in their forecasts. This means some analysts have predicted and thought through negative outcomes when they come up with a non-GAAP number.”

Meanwhile, analysts who only forecast predictions using GAAP metrics might not fully consider the potential negative outcomes. This means that when those negative outcomes do take place, there’s a negative surprise. Further tests that control for the earnings surprise supported the researchers’ hypothesis that variation across analysts in the earnings metric forecasted is associated with lower stock returns around earnings announcements.

“People would love to be able to predict something negative in the future,” said Larocque. “That’s going to be helpful not just for the companies, but for the investors who invest in those companies.”

Though the study by and large supported their hypotheses, the outcome regarding earnings surprises was somewhat unexpected. “I don’t think we expected that differences across analysts and whether they use non-GAAP would help predict future negative earnings surprises,” said Larocque. “We didn’t know that going into the project.”

She also explained how the study has further implications for others researching financial analysts. “In our paper, we come up with a measure to capture differences across analysts on whether they use non-GAAP reporting or not,” she said. “It’s a pretty easy measure for someone else to pick up and build into their study when they’re thinking about future earnings surprises or when they’re thinking about disagreement across financial statement users.”

The research team suggests that future research on analysts’ forecast accuracy, earnings surprises, analyst forecast dispersion and the market reaction to earnings should control for such definitional differences.

Larocque plans to continue probing how analysts use financial information and is working on another paper exploring non-GAAP metrics. “We investigate whether it’s associated with their valuations. It turns out, the analysts who use non-GAAP reporting are a lot more optimistic,” she said. “And not just the analysts who take out losses, but the analysts who take out gains. That’s what’s really surprising — analysts come up with non-GAAP forecasts that are lower than their GAAP forecasts and they’re even more optimistic in their valuations.”

Although a cornerstone of her course on financial statement analysis involves teaching GAAP reporting in detail, Larocque is glad she can bring her students a second perspective. “I lecture about companies using non-GAAP methods and how that is something that students might come across or they might incorporate into their own analysis of a company’s finances.”

Illustration by Errata Carmona. Photo by Barbara Johnston.

STEPHANNIE LAROCQUE is the Notre Dame Associate Professor of Accountancy and KPMG Faculty Fellow at the Mendoza College of Business.

Published

“Filling in the GAAPs in Individual Analysts’ Street Earnings Forecasts”

Management Science (2022)

Brian Bratten (University of Kentucky), Stephannie Larocque (University of Notre Dame),

and Teri Lombardi Yohn (Emory University)

Comments